It turns out renters and homeowners are living in two entirely different economies, at least according to a new study by the Federal Reserve. Who, ironically enough, made it happen.

In short, renters are in dire straits financially, while homeowners are "continuing to reap the rewards" of cheap pandemic money that left renters with nothing but inflation.

This is "complicating" the Fed's crystal ball as homeowners continue to splurge on everything from travel to eating out, "propping up prices with their discretionary spending power."

Of course, the Fed's money printers are what's propping up prices. But the robust homeowner spending means they're not seeing the distress.

I've mentioned in a recent article how the Fed money printer works by injecting new money into asset markets. Which leaves the rich richer and the poor coping with inflation.

That process goes on turbo when they crank up the money printers, which they did during the pandemic to the tune of $7 trillion fresh dollars -- one in three.

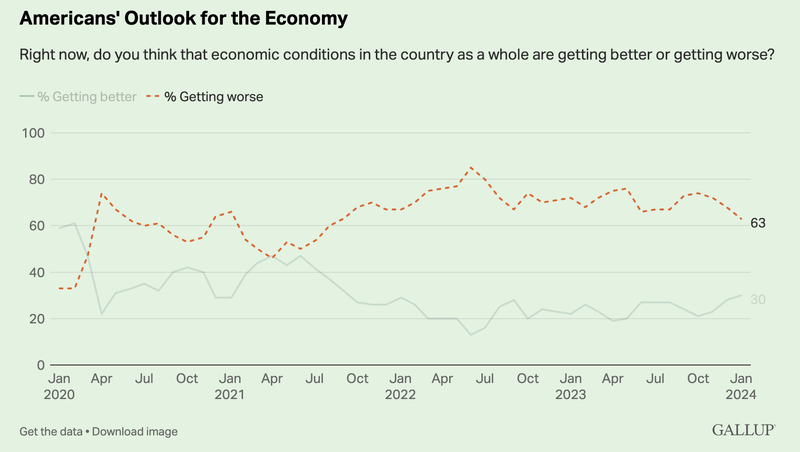

Hence the media's favorite economic theme these days: Why Americans can't see the glory of Bidenomics. After all, if you're a journalist at the New York Times, or an economics professor at Harvard, everybody at your dinner parties owns a home. They own stocks. They're doing great, regaling one another about their investing acumen.

Alas, the 90% aren't at those dinner parties to regale. They can only speak in ballot boxes.

Heaven at the top, Hell at the Bottom

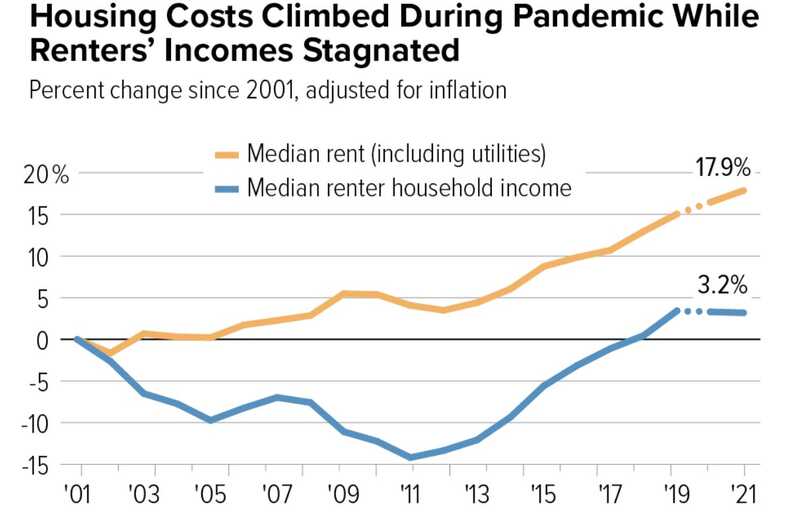

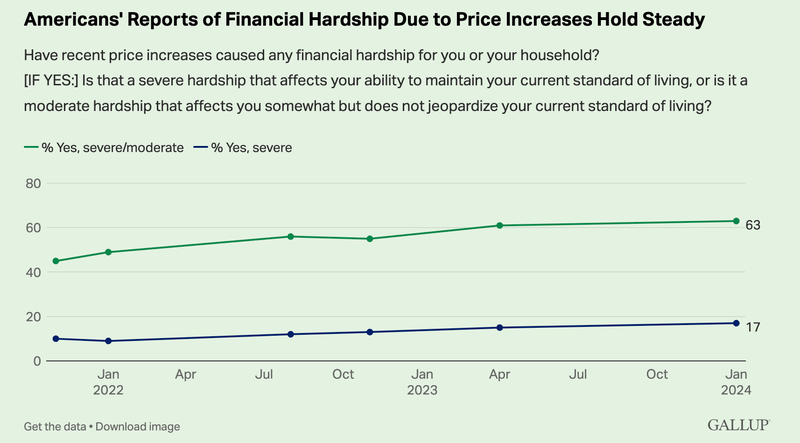

In raw numbers, the Fed report finds that nearly 1 in 5 renters fell behind on their rent in the past year, while rents have soared 20% since the pandemic -- coming to nearly $400 for the average renter.

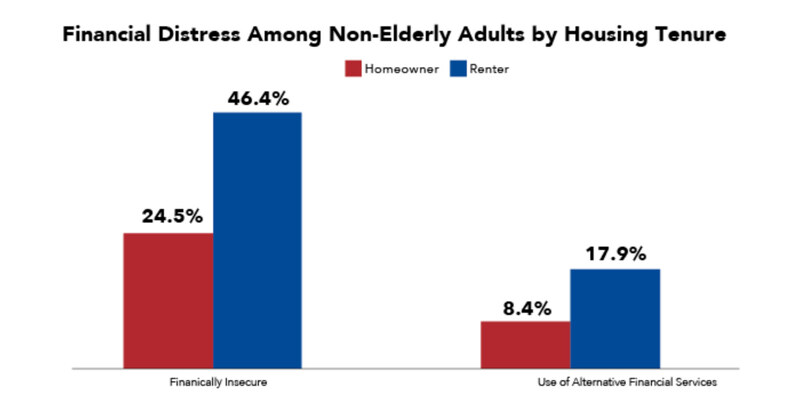

Renters are more likely to not be able to pay the electric, water, or gas bill in the past month, and they report much higher rates of financial anxiety.

This all might rankle when CNN lectures them how amazing the economy is.

It's a whole nother world for homeowners, who overwhelmingly refinanced during the pandemic at average rates around 3%, taking hundreds of thousands out of their Fed-pumped home.

They plowed a good chunk of that money into stocks, which also soared thanks to the Fed's near-zero interest rates -- the so-called "everything bubble." Courtesy of the Fed.

That means homeowners actually saved money compared to pre-pandemic. They had a larger mortgage, sure, but at 3% the Fed actually lowered their monthly nut.

When the smoke cleared, the money printing orgy was a bonanza for the wealthy. And it was a cruel joke on everybody else, above all on the young stuck watching that ship sail further and further away, giving up on starting a family, instead returning to Mom's basement to complain about capitalism.

End the Fed, Drain the Swamp

The rule of thumb in Washington is that the rhetoric is for the middle and working class -- voters -- yet the policies are for the wealthy. Because the wealthy donate.

This means that government policies are bedazzled in sweet nothings about the less fortunate or, these days, the under-represented. But when the music stopped, somehow the poor didn’t get a thing; it was the wealthy who got the goodies.

The solution's easy: Get the government out of the economy. End the Fed, drain the swamp.

Of course, they'll fight that with everything they've got.

About the Author:

Peter St. Onge writes articles about Economics and Freedom. He's an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.